The Different Ways to Trade Currencies

Together with selecting a buying and selling approach and a forex pair, buyers additionally need to pick out a market in which to exchange currencies. There are several distinctive markets to be had to exchange currencies inclusive of the foreign exchange market, derivatives markets and trade-traded budget. here is a short description of each market.

Foreign Exchange Buying and Selling

A majority of currency trading takes place within the forex spot marketplace. on this market, huge banks and other monetary establishments change currencies among themselves both for instant delivery (spot marketplace) or for agreement at a later date (forward marketplace).

Trades within the foreign exchange market occur over-the-counter, and the minimum size of the trades may be very large. inside the past it has been impractical for individual investors to change inside the forex marketplace for those motives.

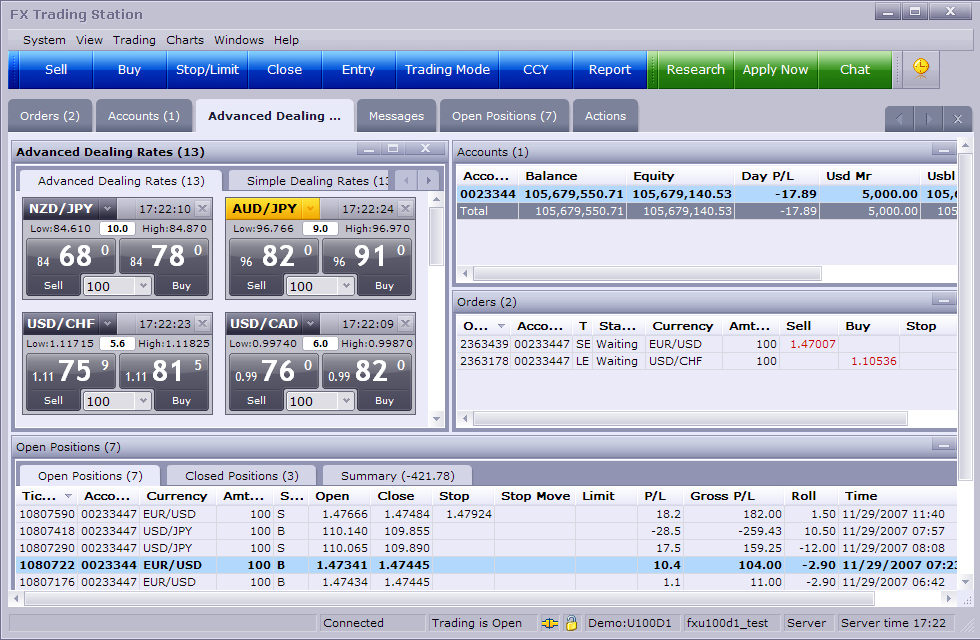

However, over the last numerous years, a new retail foreign exchange marketplace has developed. This market allows character investors and small establishments to trade inside the foreign exchange marketplace with smaller volumes than those who have been formerly to be had.

Derivatives Markets

Derivatives include futures, options and exotic, customizable spinoff contracts. The more exceptional derivatives are generally designed for institutional investors, even as individual traders often trade futures and options.

The most popular currency pairs have each futures contracts and options on those futures contracts. individual traders are in a position to shop for or promote the futures or the alternatives to invest at the route of the currency pair. those futures and alternatives typically feature reasonably exact liquidity, transparent pricing and slight capital requirements.

For these motives, futures or options are a feasible choice for individual investors interested in the foreign money market.

While using futures or alternatives, it's very critical to apprehend the dangers involved in the usage of those monetary units. despite the fact that large profits are viable, the majority of traders the use of those securities sooner or later lose cash. Futures contracts also bring the possibility of doubtlessly limitless losses.

Investors need to carefully don't forget their chance tolerance and punctiliously understand doubtlessly damaging rate moves, before considering a futures trading strategy.

Exchange Traded Budget (ETFs)

ETFs have been famous motors for tracking stock and bond indexes for years, however, they may be a incredibly new addition to the sector of forex. A currency ETF can be offered and offered much like any other inventory.

An investor who believes a forex is about to upward push in charge can purchase the ETF. then again, an investor who believes a currency will decline in price should sell the ETF.

An advantage to trading ETFs is that they're extra acquainted to the common investor than the forex or derivatives markets. ETFs also convey stricter margin necessities, so they will attraction to greater hazard-averse buyers.

Foreign Exchange Buying and Selling

A majority of currency trading takes place within the forex spot marketplace. on this market, huge banks and other monetary establishments change currencies among themselves both for instant delivery (spot marketplace) or for agreement at a later date (forward marketplace).

Trades within the foreign exchange market occur over-the-counter, and the minimum size of the trades may be very large. inside the past it has been impractical for individual investors to change inside the forex marketplace for those motives.

However, over the last numerous years, a new retail foreign exchange marketplace has developed. This market allows character investors and small establishments to trade inside the foreign exchange marketplace with smaller volumes than those who have been formerly to be had.

Derivatives Markets

Derivatives include futures, options and exotic, customizable spinoff contracts. The more exceptional derivatives are generally designed for institutional investors, even as individual traders often trade futures and options.

The most popular currency pairs have each futures contracts and options on those futures contracts. individual traders are in a position to shop for or promote the futures or the alternatives to invest at the route of the currency pair. those futures and alternatives typically feature reasonably exact liquidity, transparent pricing and slight capital requirements.

For these motives, futures or options are a feasible choice for individual investors interested in the foreign money market.

While using futures or alternatives, it's very critical to apprehend the dangers involved in the usage of those monetary units. despite the fact that large profits are viable, the majority of traders the use of those securities sooner or later lose cash. Futures contracts also bring the possibility of doubtlessly limitless losses.

Investors need to carefully don't forget their chance tolerance and punctiliously understand doubtlessly damaging rate moves, before considering a futures trading strategy.

Exchange Traded Budget (ETFs)

ETFs have been famous motors for tracking stock and bond indexes for years, however, they may be a incredibly new addition to the sector of forex. A currency ETF can be offered and offered much like any other inventory.

An investor who believes a forex is about to upward push in charge can purchase the ETF. then again, an investor who believes a currency will decline in price should sell the ETF.

An advantage to trading ETFs is that they're extra acquainted to the common investor than the forex or derivatives markets. ETFs also convey stricter margin necessities, so they will attraction to greater hazard-averse buyers.

Post a Comment for "The Different Ways to Trade Currencies"